Summary

Japan – the underrated story for the last two years. In the following note we reflect on the recent strong outperformance of Japanese equities and examine several catalysts. We argue that these catalysts are priced in and the BoJ’s (Bank of Japan) exit from negative interest rates has implications for the Yen, bonds, and equities as the preferences of domestic investors change.

Performance

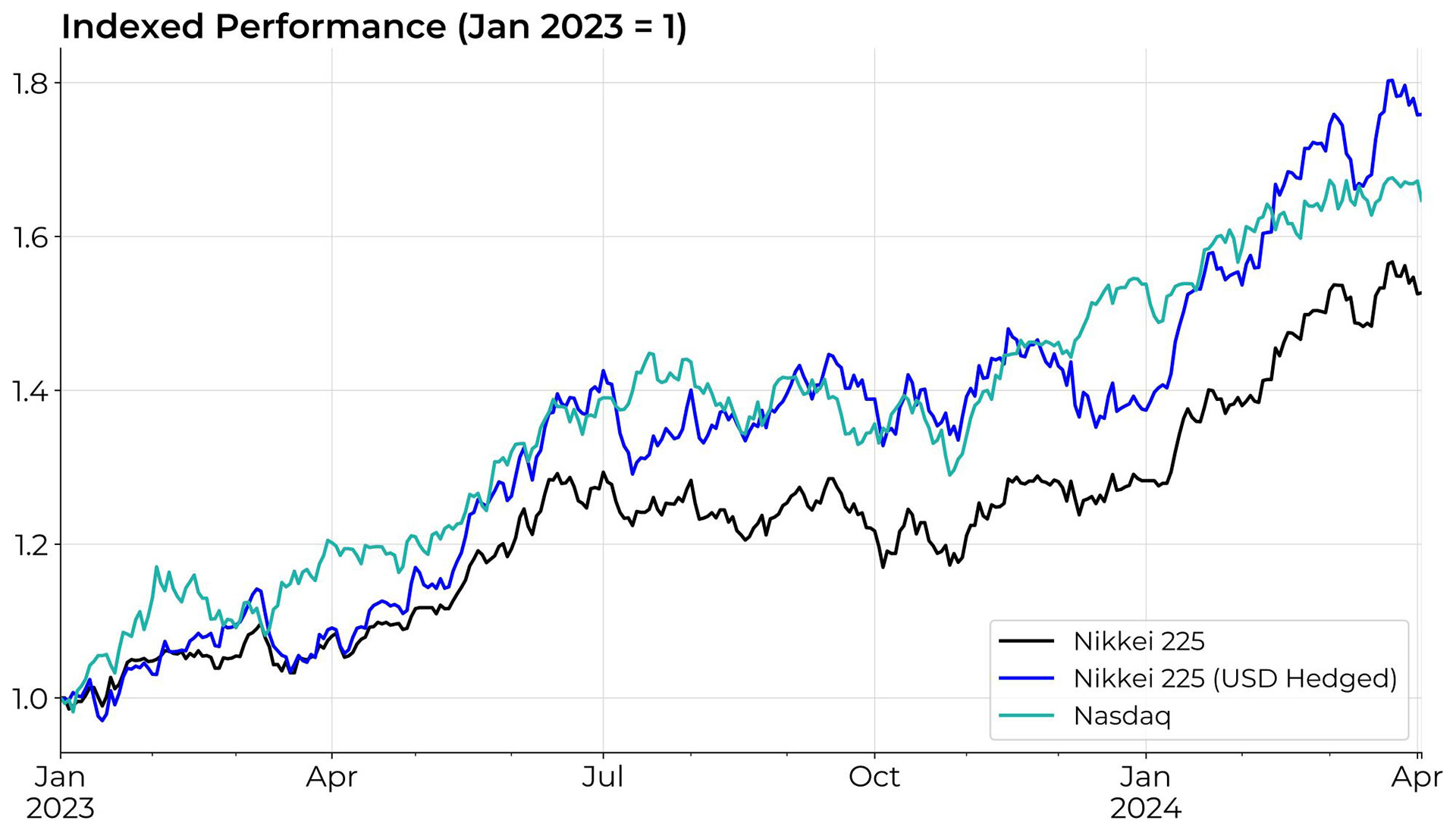

Starting from 2023, the Nikkei outperformed both the S&P 500 and Eurostoxx 50 indices in local currency terms. On a hedged basis, Japan equities even outperformed the Nasdaq! In 2023 the Nikkei delivered 28.2% in local currency terms and 35.8% hedged versus the Nasdaq’s 53.8%. Then, since the beginning of 20241 the Nikkei’s unhedged and hedged returns are 19% and 26.5% respectively, versus 7.7% for the Nasdaq. The Nikkei recently broke through 38,915 – the all-time nominal high set on December 29th, 1989. An era when the value of the Imperial Palace in Tokyo was higher than all the real estate in Orange County, California.

Catalysts

1. Corporate Reforms

Japanese companies are improving corporate governance, increasing share buybacks, and reducing cross holdings. The rollout, albeit slow, has improved the attractiveness of Japanese equities.

2. Buffett’s Endorsement

In 2020, Berkshire Hathaway bought stakes in five Japanese conglomerates2 funded with Yen denominated debt. Warren Buffett travelled to Japan in April 2023 where he commented positively on Japan’s economy and stock market. He revealed Berkshire had increased its conglomerate stakes which helped fuel animal spirits and pushed Japanese equities higher into summer 2023.

3. BoJ Policy

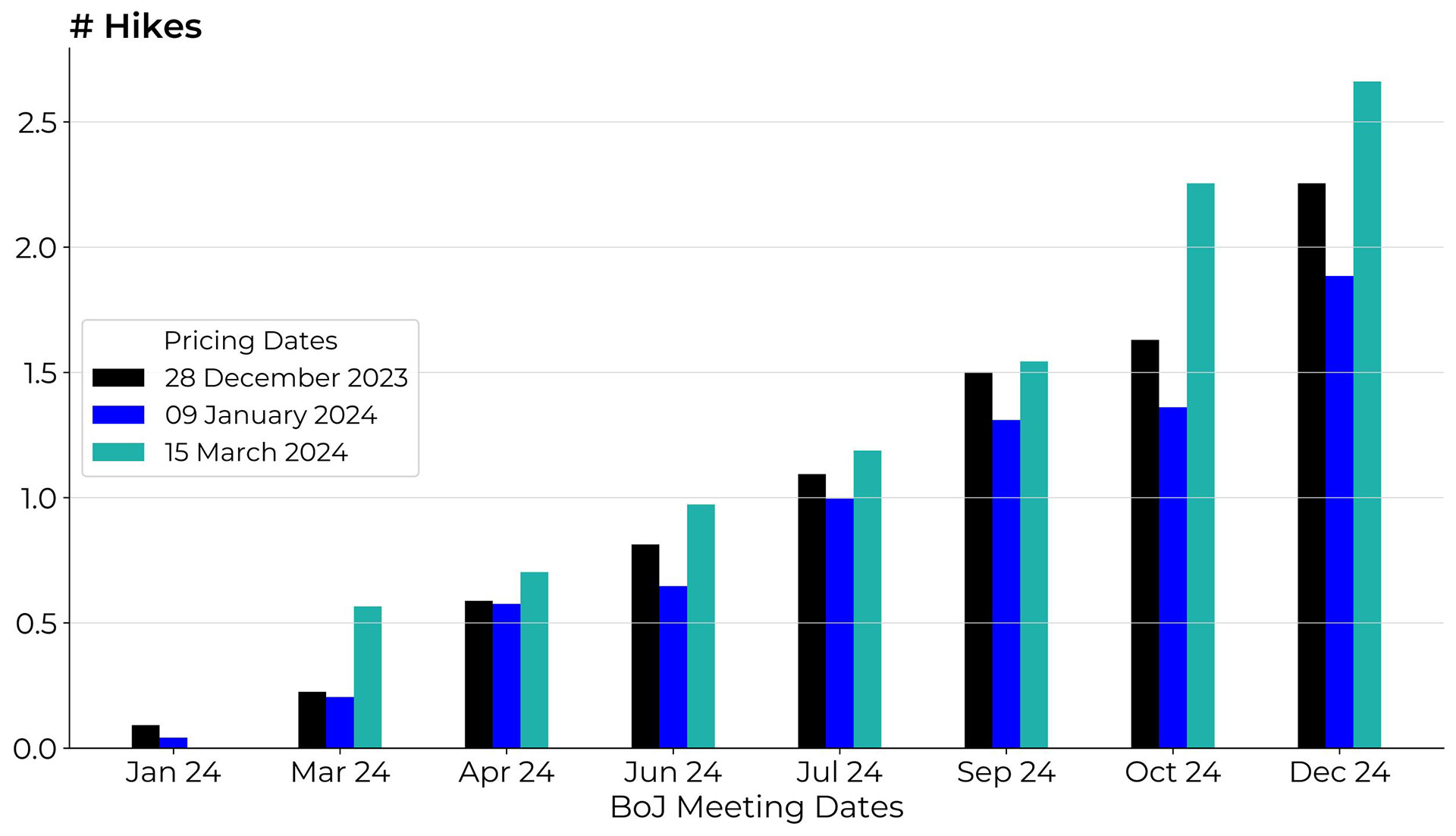

The BoJ delayed its exit from negative rates due to the Noto earthquake on January 1st, 2024. At the end of 2023 – before the earthquake – the market priced the chance of a hike at the January 2024 policy meeting. Post earthquake the market pushed out hikes and priced a more dovish BoJ path helping the Nikkei rally at the start of 2024. Performance came under pressure as hawkish commentary from policy makers suggested the March meeting was live for an exit from negative interest rates3. Remember, the BoJ had not raised rates since 2007.

The BoJ confirmed its exit from negative rates at the recent March policy meeting, moved the target range to 0%-0.1%, scrapped yield curve control and ETF buying in the open market. Although YCC was removed, the BoJ will continue to purchase JGBs via its QE program. The news was well telegraphed. The BoJ also signaled a dovish bias in its commentary and there was not unanimous agreement on raising the policy rate. The Yen sold off sharply post meeting and the Nikkei rallied. Recall, foreign exchange is a pair trade with two sides. The USD rose in March as yields firmed into the March 20th Federal Reserve policy meeting. The USD rise combined with extended short-term positioning in Yen longs into the BoJ meeting was sufficient to trigger a sharper price movement with USDJPY leading equities once the market digested the BoJ meeting.

Five-year breakeven inflation rates are discounting sustained higher inflation around 1.4%, the January core inflation release was 2.0% and the recent round of Shunto4 wage negotiations suggest Japan is finally exiting its deflationary trap. The BoJ’s policy pivot is consistent with underlying macroeconomic fundamentals.

The BoJ was buying ETFs to support equities when the TOPIX declined more than 2% in a session. They reduced the size of the purchases post COVID and own 7%5 of the market capitalization on the Tokyo Stock Exchange. Notably the BoJ was an absent buyer during the week of March 11th prior to the policy meeting where it was confirmed they would no longer purchase ETFs in the open market. This removes a support for equities on the downside.

Finally, the Nikkei will not be insulated from a broader selloff in global equities as developed equity markets exhibit high correlations. One scenario is the US leads a correlated decline in equities led by weakness in the technology sector which has been a significant support to the performance of US stocks. In this scenario, the Nikkei will selloff and the Yen will exhibit defensive properties and rally.

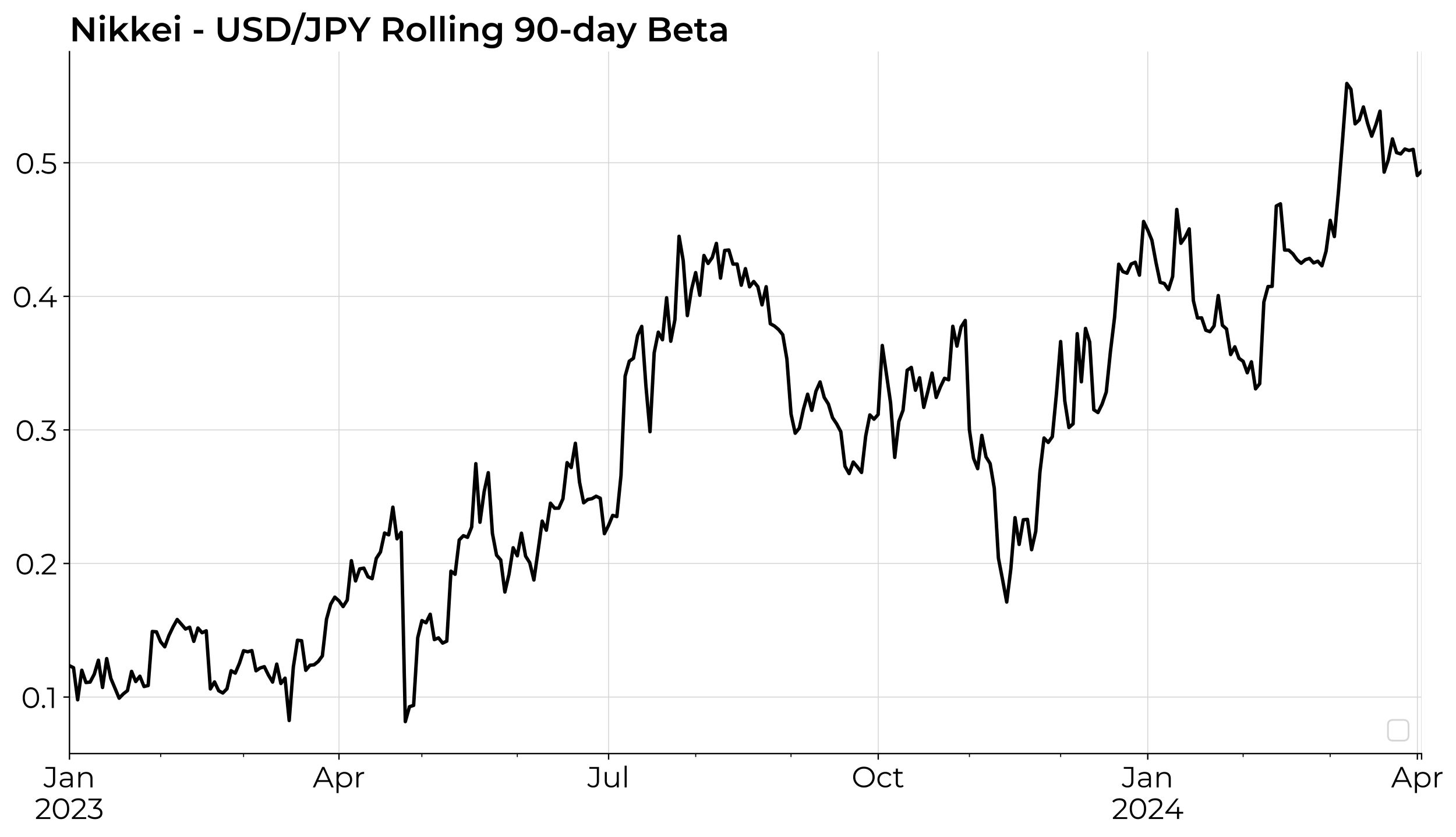

4. Foreign Exchange Pass Through

Japan is home to several multinationals including Toyota, Sony, and Nintendo with large foreign-based revenue. A weakening FX helps profitability as Japanese corporates translate foreign revenue into Yen terms. There is a weak relationship between USDJPY and Nikkei where currency weakness tends to support equities.

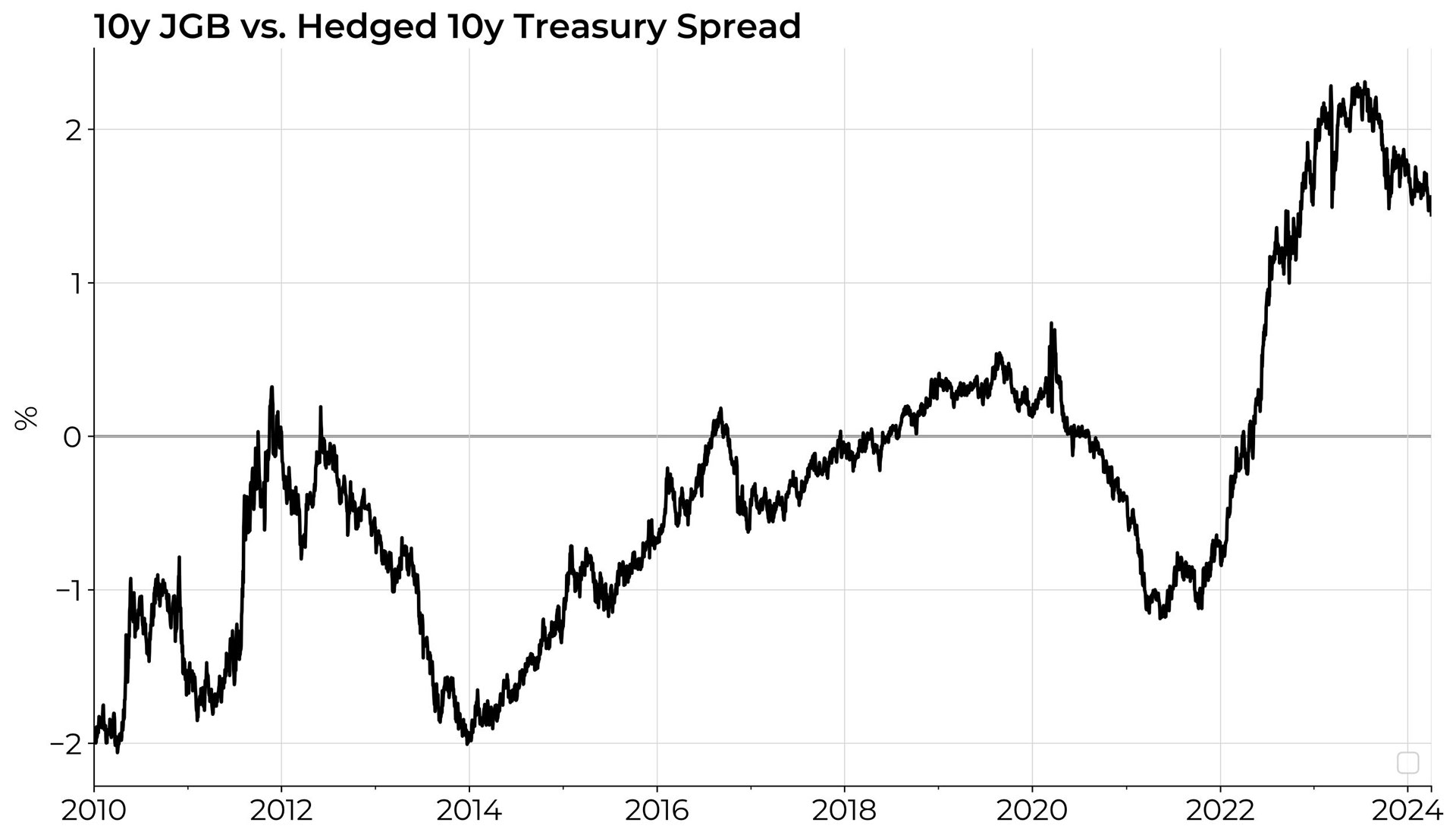

Japanese Holdings of Foreign Assets

Japan recycles a large amount of savings into global financial markets including equities and bonds. Japan currently holds over $2 trillion in foreign bonds including $1.1tn in US Treasuries6. A segment of Japanese domiciled investors including pensions and insurers will consider total return, including hedging costs when assessing the attractiveness of owning foreign securities to make portfolio allocation decisions. Below we show the yield spread between owning a 10-year JGB and a 10-year Treasury bond with a one-year hedge. The Federal Reserve’s hiking cycle significantly increased the cost of hedging USD denominated assets as the yield differential widened between the US and Japan, eroding the attractiveness of hedged USD assets for Japanese domiciled investors who FX hedge foreign assets. With the BoJ’s exit from negative rates and the removal of yield curve control, we could see a repatriation of capital into Japan’s fixed income market. In terms of asset prices, a reversal of Japanese hedged foreign asset flows will pressure USD denominated bonds lower – corporates, agencies, and Treasuries – and the Yen should appreciate as capital flows into the domestic bond market. This is a potential long term structural support for the Yen and JGBs.

Takeaways

- Japanese stocks, particularly on a hedged basis, have enjoyed an impressive rally over the last 15 months.

- Several positive catalysts are already priced in, including improved fundamentals, corporate reforms, and Buffett’s one-off endorsement.

- A weaker Yen supports Japanese equities.

- Equity longs and Yen shorts are crowded.

- The BoJ exiting its stimulative policies has implications for the investment preferences of Japanese based investors who hedge foreign assets.

- We suspect the positive support of these catalysts for hedged Japanese equities will soon face headwinds

1As of 2 April 2024.

2Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo

3The BoJ’s ‘Negative Interest Rate Policy’ or NIRP

4Unions and management set monthly wages before the start of Japan’s fiscal year

5As of September 2023

6As per Bloomberg

Disclaimer

ANY DESCRIPTION OR INFORMATION INVOLVING MODELS, INVESTMENT PROCESSES OR ALLOCATIONS IS PROVIDED FOR ILLUSTRATIVE PURPOSES ONLY AND DOES NOT CONSTITUTE INVESTMENT ADVICE NOR AN OFFER OR SOLLICITATION TO SUBSCRIBE FOR ANY SECURITY OR INTEREST. ANY STATEMENTS REGARDING CORRELATIONS OR MODES OR OTHER SIMILAR BEHAVIORS CONSTITUTE ONLY SUBJECTIVE VIEWS, ARE BASED UPON REASONABLE EXPECTATIONS OR BELIEFS, AND SHOULD NOT BE RELIED ON. ALL STATEMENTS HEREIN ARE SUBJECT TO CHANGE DUE TO A VARIETY OF FACTORS INCLUDING FLUCTUATING MARKET CONDITIONS AND INVOLVE INHERENT RISKS AND UNCERTAINTIES BOTH GENERIC AND SPECIFIC, MANY OF WHICH CANNOT BE PREDICTED OR QUANTIFIED AND ARE BEYOND CFM’S CONTROL. FUTURE EVIDENCE AND ACTUAL RESULTS OR PERFORMANCE COULD DIFFER MATERIALLY FROM THE INFORMATION SET FORTH IN, CONTEMPLATED BY OR UNDERLYING THE STATEMENTS HEREIN. CFM ACCEPTS NO LIABILITY FOR ANY INACCURATE, INCOMPLETE OR OMITTED INFORMATION OF ANY KIND OR ANY LOSSES CAUSED BY USING THIS INFORMATION. CFM DOES NOT GIVE ANY REPRESENTATION OR WARRANTY AS TO THE RELIABILITY OR ACCURACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT.