The performance of US technology shares impacts a large set of global portfolios – the retail investor saving for retirement, the hedge fund manager managing monthly performance and the real money community harvesting the equity risk premium to service liabilities. Investors have come to rely on the superior companies on offer in the United States, transparent rule of law and protection of assets and access to the deepest markets in the world. With years of ‘magnificent’ performance from America’s greatest technology companies we highlight 7 reflections below and make a case for greater investor caution.

Reflection #1 – Everybody Loves a Great Story

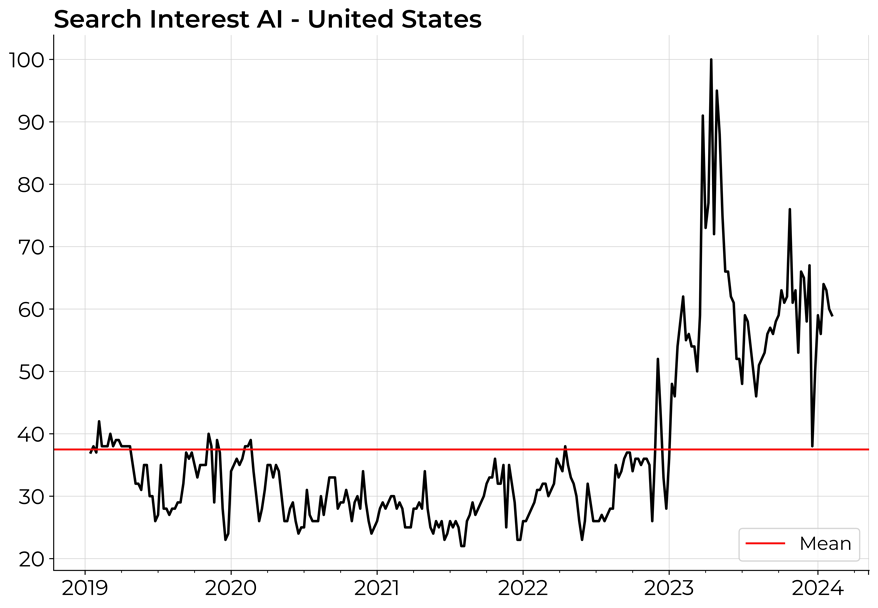

How do you value a non-zero probability of Artificial General Intelligence (AGI)? In the short to medium term the economic gains would be massive. In the long run the machine might redesign the entire economic system eliminating the need for money. Free energy and autonomous robots catering to all our desires. We are so far from this outcome currently but the drip feed of examples of machines completing more human like tasks is impressive and has stoked animal spirits around the AI theme. Recent interviews with Jensen Huang1 identify several use cases including enhancing productivity of coders, chip design, drug development and personal assistants. Sam Altman2 abstracts even more, his logic is a machine with general intelligence will create its own use cases. A great narrative attracts a great deal of flow and investors have piled into the AI & AI adjacent themes. The market is a ruthless master and will start demanding evidence of use cases and monetization paths. Do you have your personal assistant yet?

Reflection #2 – Concentration

The beauty of a broad equity index like the SPX is it reflects the collective valuation assessment of a wide range of investors, from passive to active. Although passive versus active equity market share has risen from roughly 48% in 2019 to 58% in 20243, passive investors can still free ride on the work of active managers as they commit resources to reward winners and punish losers. There is an automatic attrition for index holders which allows them to own the higher performing firms over time. We show the top five names in the SPX as a percentage of market cap over time. Concentration has never been higher exceeding levels in the dotcom crash. The success of several institutional and retail retirement portfolios is the result of long-term passive indexing and harvesting the equity risk premium. Over trading and panicking on selloffs tends to lead to poor results for most investors. The increasing concentration of technology in the SPX is in large part an artefact of the success of these companies and the changing composition of the US economy to all things digital. The M7 earn, grow and scale and have been rewarded by the market. The problem with concentration and story love affairs with the market is eventually the narrative pivots and investors look for the next compelling story. The concentration and subsequent rotation and destruction of capital leads to rapid corrections in valuations.

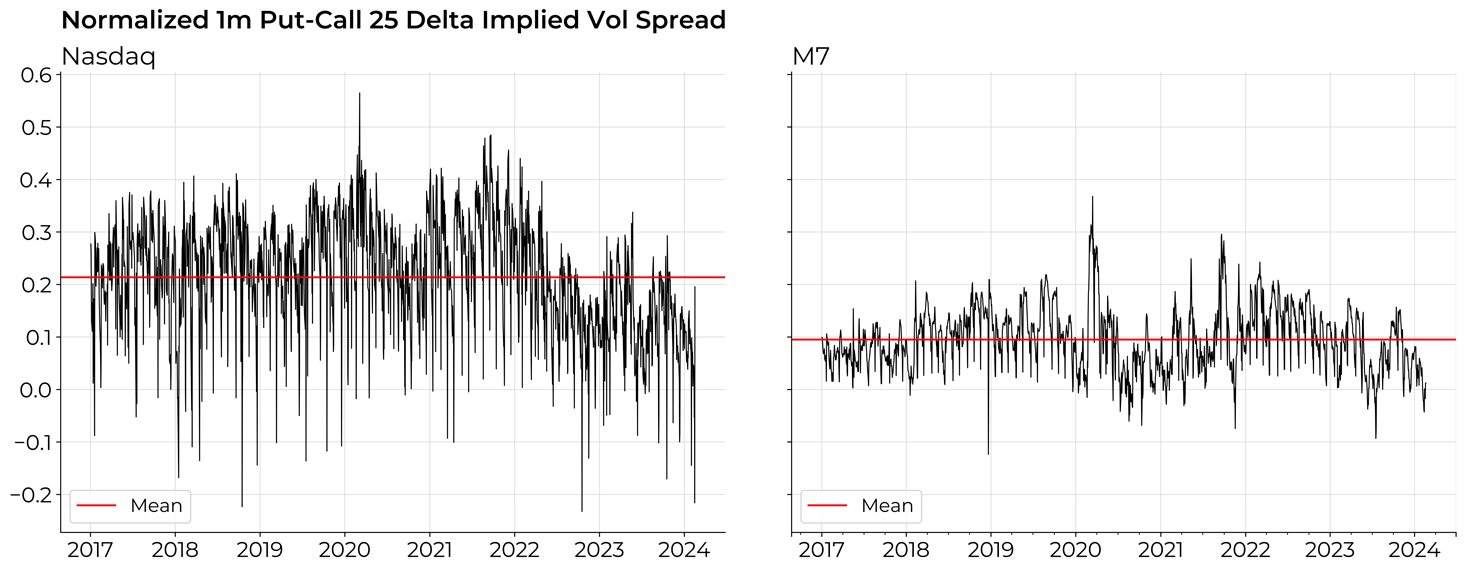

Reflection #3 – Large % of Trades are Unrelated to Fundamentals

Robert Schiller4 is right. Fundamentals explain a small percentage of total stock market volatility. The balance or excess volatility is human nature (greed, envy etc.) and a large group of investors who transact with different utilities (e.g. rule based strategies, hedgers & market makers). CFM5 reaches a similar conclusion using a bottom-up market structure argument. The charts above show demand for call options on the Nasdaq and average for the M7. Calls have increased in value relative to puts as investors purchase them to speculate on the rally or replace stock holdings to protect gains. A market maker sells this option and hedges the embedded exposure to lock-in the spread captured from the bid & offer – they are not interested in the direction of Tesla. The option has a dynamic exposure to the underlying, as the stock continues rising into purchased call strikes, the market maker buys more stock to remain hedged. In short, a large demand for naked call options creates a reflexive price dynamic that fuels the rally. Call option volumes have risen materially on the rally. The process is vulnerable to reversal on weakness and a similar dynamic can occur on the downside as investors purchase puts for protection when the frame shifts away from perceived positive catalysts.

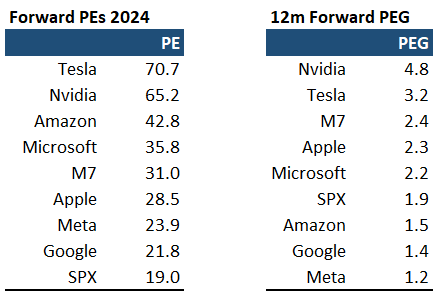

Reflection #4 – Fundamentals

With 2024 forward PEs ranging from 22x in the case of Google to 70x for Tesla, investors are paying a hefty premium for future earnings. One misconception about recent equity strength is gains are largely due to multiple expansion. In fact, earnings growth and dividends have contributed to a larger share of gains than multiple expansion. The M7 are valuable because they scale and grow. The market rewarded them for growth which exceeded expectations in 2023. Examining the forward PEG ratios values earnings growth, the picture is less extreme than forward PE ratios with a few names in the M7 cheaper than the overall market. The problem with rapid rates of growth is they eventually revert to the mean as market share saturates, innovation slows down and competitors emerge, attracted by abnormal profits. Although sell-side equity analysts have a mixed track record, they are forecasting muted earnings growth for the M7 in 2024 versus realized in 2023. Overall, the names look rich and will struggle to grow into the AI narrative the market has already prepaid. For example, Nvidia has added $1.4tn to its market capitalization from the start of 2023 with the market aggressively pricing a significant amount of future growth. This leaves the M7 susceptible to a correction as the market eventually reframes the fundamental narrative.

Reflection #5 – Opportunity Costs

The forward earnings yield is one over the forward PE. Technology stocks are offering earnings yields on the order of 150bp to 450bp. With policy rates higher, sovereign bonds and corporate credit finally offer a viable alternative to investors with significantly lower risk. For investors with explicit liabilities in real or nominal terms, the return of lower risk non-equity assets is a viable addition to a diversified portfolio. Memories are short. Let’s not forget that many profitable technology companies that survive today spent two years declining as the market ignored fundamentals and de-leveraged post the 2000 bubble popping.

Reflection #6 – Mark-to-Market is not Liquidation Value

The idea6 is straightforward: how much market capitalization is created in response to one dollar invested in the market? The effect is on the order of 1x for a stock and 5x for an index of (correlated) stocks. The ‘gains’ we see in our investment portfolios or retirement accounts are paper gains, not cash-in-hand. The clearing price is much lower or higher when investors are aggressively selling or buying. The concentration in the M7 could lead to a rapid and permanent readjustment of market value as paper gains are destroyed.

Reflection #7 – Negative Catalysts

The sheer size and profitability of the M7 has seen a rise in discussions around monopoly power7 both in the US and Europe. Microsoft went through antitrust issues in 2001. The US election will dictate the odds of actual action with Democrats and Republicans having different views on regulating industry. In Europe, more regulations are coming particularly with regards to AI. Finally, with earnings behind us we lose a catalyst to drive technology shares higher in the coming months.

Where does that leave us?

- AI has a lot of hype. The market will start demanding results.

- A concentrated index is vulnerable to pullback.

- Two-way price risk may arise from ‘forced-to-trade’ market participants.

- Valuations that look rich versus earnings, look a bit better versus earnings growth.

- Viable alternatives to these stocks exist with lower risk as yields look more attractive.

- One dollar of index buying or selling does not translate to a dollar of market cap. A flow of simultaneous sell orders in a concentrated index can lead to a destruction of market value.

- Negative catalysts exist including anti-trust chatter and lack of earnings catalysts.

The run is truly magnificent and the M7’s ability to innovate and deploy at scale is unprecedented. These companies are not napkin business model remnants from the dotcom crash. Reliance on performance of US technology shares has never impacted so many portfolios globally and given the ‘magnificent’ run we believe investors should be cautious with their exposures.

1 https://www.nbim.no/en/publications/podcast/guest-jensen-huang-founder-and-ceo-of-nvidia/

2 https://www.nbim.no/en/publications/podcast/sam-altman-ceo-of-openai-chatgpt-future-of-ai-agi-and-china/

3 Bloomberg Finance LP

4 https://www.jstor.org/stable/2006543

5 https://arxiv.org/pdf/2108.00242.pdf

6 https://arxiv.org/pdf/2108.00242.pdf

7 https://www.ft.com/content/4eec8bc3-c892-4704-ae66-a4432c6d4fd7

Disclaimer

ANY DESCRIPTION OR INFORMATION INVOLVING MODELS, INVESTMENT PROCESSES OR ALLOCATIONS IS PROVIDED FOR ILLUSTRATIVE PURPOSES ONLY AND DOES NOT CONSTITUTE INVESTMENT ADVICE NOR AN OFFER OR SOLLICITATION TO SUBSCRIBE FOR ANY SECURITY OR INTEREST. ANY STATEMENTS REGARDING CORRELATIONS OR MODES OR OTHER SIMILAR BEHAVIORS CONSTITUTE ONLY SUBJECTIVE VIEWS, ARE BASED UPON REASONABLE EXPECTATIONS OR BELIEFS, AND SHOULD NOT BE RELIED ON. ALL STATEMENTS HEREIN ARE SUBJECT TO CHANGE DUE TO A VARIETY OF FACTORS INCLUDING FLUCTUATING MARKET CONDITIONS AND INVOLVE INHERENT RISKS AND UNCERTAINTIES BOTH GENERIC AND SPECIFIC, MANY OF WHICH CANNOT BE PREDICTED OR QUANTIFIED AND ARE BEYOND CFM’S CONTROL. FUTURE EVIDENCE AND ACTUAL RESULTS OR PERFORMANCE COULD DIFFER MATERIALLY FROM THE INFORMATION SET FORTH IN, CONTEMPLATED BY OR UNDERLYING THE STATEMENTS HEREIN. CFM ACCEPTS NO LIABILITY FOR ANY INACCURATE, INCOMPLETE OR OMITTED INFORMATION OF ANY KIND OR ANY LOSSES CAUSED BY USING THIS INFORMATION. CFM DOES NOT GIVE ANY REPRESENTATION OR WARRANTY AS TO THE RELIABILITY OR ACCURACY OF THE INFORMATION CONTAINED IN THIS DOCUMENT.”