Foreign Holders of US Assets – Is US Exceptionalism Over?

Summary

In this note we discuss foreign ownership of US assets and whether foreign investors are re-evaluating investment in the US. Foreigners own approximately 20% of US equities, 30% of Treasuries and 30% of US corporate credit1. The current Administration’s policy shifts, and its likely impact on their US portfolio holdings, are an important topic of discussion for global investors. We argue that calling the end of US exceptionalism is premature, particularly for equities, however, policy shifts are already impacting performance – or the exceptionalism – of US fixed income and the dollar. For investors, the expected total return of investment is a key metric when deciding how to allocate capital. We argue the US total return proposition is eroding, particularly for foreign investors.

Dollar Exceptionalism Under Pressure

The Administration’s policy choices are weakening the dollar. One objective, the re-shoring of manufacturing capacity from large trade partners including China benefits from a weaker exchange rate and is an expedient mechanism to rectify trade imbalances2. Figure 1 shows the real, trade weighted US dollar is trading at historically expensive levels. The performance of the dollar has diverged from interest rate differentials as well, suggesting a persistent flow to sell dollars. Speculators, hedge ratio adjustments, total return considerations, asset allocation decisions and outright selling of dollar denominated assets are likely contributors.

In this sense, the dollar is already losing its exceptionalism due to its impact on the total returns of dollar holdings. Figure 2 shows why this is a pressing portfolio decision for foreign investors. We show unhedged returns for the S&P500 and the ten-year US Treasury. Unhedged European investors have lost 13.55% year-to-date from foreign exchange translation and are earning unattractive total returns.

Hedging also comes with a cost. We show the one-year hedging costs of selling dollars forward for various countries. Investors incorporate this information into total return expectations and adjust portfolios accordingly. Historically, foreign investors have run light hedge ratios on the dollar to benefit from the well-known dollar smile. The dollar tends to perform when the US economy is healthy and during periods of crises, the result of the dollar’s reserve currency status and large dollar denominated liabilities. This property provided attractive diversification benefits to foreign investors. The underperformance of the dollar year-to-date suggests global investors are adjusting exposure to dollars and dollar denominated assets as the total return of US assets becomes less attractive.

US Treasuries Exceptional?

Government debt denominated in the world’s reserve currencies is fungible with large holders considering opportunities on a total return basis. For example, a US based investor can purchase 30-year JGBs and hedge the Yen risk to yield 6.47%, higher than the prevailing 4.86% on US 30-year Treasuries3. Conversely, a hedged Japanese investor is now better off buying long end JGBs for a yield pick-up. Large bond portfolios held by reserve managers, central banks, pension schemes and government-related entities are slow to change investment mixes but once they start moving, it leaves a long memory on asset prices. Investors change portfolio allocations to increase the probability of meeting nominal or real return targets or immunizing liabilities.

One property of US markets is the deep liquidity available to investors. The prevailing paradigm for the last several decades was the tacit agreement that the US would be the world’s consumer, purchasing goods & services from rest-of-world with borrowed money, loaned by rest-of-world at sub-market rates4 to finance consumption above what the US can domestically produce. The US produces an enormous amount of financial assets to absorb rest-of-world savings and until recently, no other countries have been willing to serve this function. This might be changing in Europe, with concrete talk of finally creating a Eurobond market and large country fiscal packages including Germany and France. Even ECB President Lagarde seems comfortable with a stronger Euro5. A liquid alternative to safe dollar collateral will shift portfolio allocations overtime.

In Figure 3 we show the largest foreign holders of US Treasuries. The largest holders include: (i) countries with well-developed savings schemes but smaller domestic markets incapable of absorbing these savings, (e.g. Canada & Australia); (ii) countries with a large US trading relationship which recycle excess savings to the US (e.g. China); and (iii) open economies with large financial sectors (e.g. UK, Switzerland).

In a world with lower expected US total returns and reduced trade, America’s largest investing and trading partners are likely to recycle less capital back to the US as trade surpluses and total returns shrink. This implies less demand for dollar assets overtime.

US Equities are Exceptional

When it comes to investor allocations to equities, reducing exposure to the US is a harder decision. The outperformance of US stocks is the result of superior earnings versus rest-of-world. Over the last few decades US earnings have come-in higher than discounted leading to valuation expansion. An important part of this story is the dominance of the US technology sector. The business models of the large technology incumbents exhibit hyper-scaling properties which have allowed for sustained earnings growth6. Silicon Valley is still waiting for a credible competitor with various countries failing to create the same network effects. One way of stating this is the largest technology company in Europe, SAP trades at 51x earnings7. Investors have limited country choice for liquid exposure to mega cap technology shares. China is already creating technology companies on par with the US, but they do not command similar valuations due to investor caution over the structure of Chinese financial markets. We could see this shift overtime as China liberalizes its financial markets and the Renminbi increases its share of global transactions.

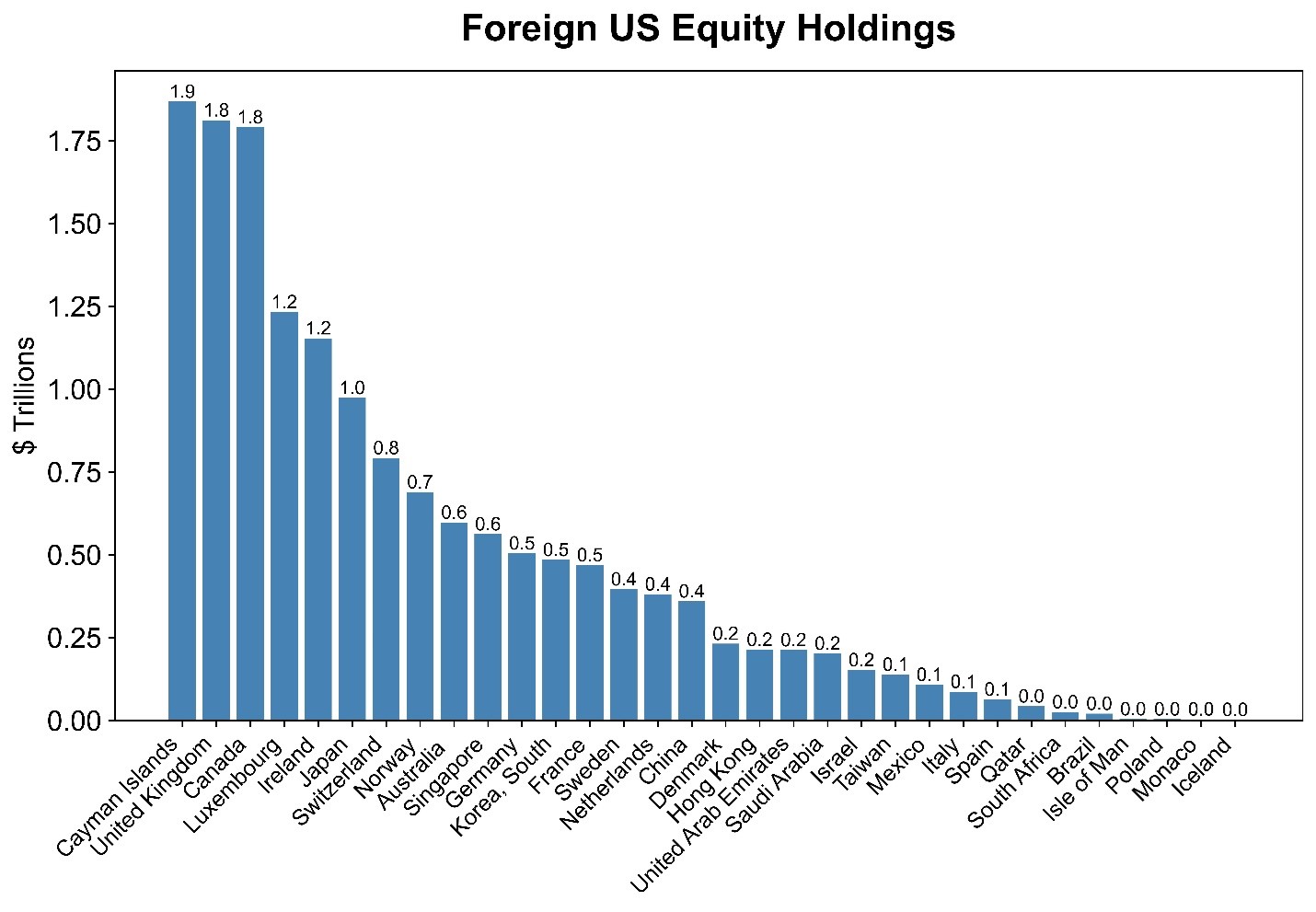

In Figure 4, we show the largest foreign holders of US equities. Similar to Treasuries, countries with excess savings, trade surpluses or large financial sectors are unsurprisingly the largest foreign holders of US equities. These are the countries to watch in terms of portfolio re-allocations. A large percentage of these assets are held by large pension schemes, reserve managers and central banks. We have not seen large scale portfolio re-allocations from US equities yet, but total return expectations continue to erode at the margin.

Takeaways

- Expected total returns are a key input for investors when deciding how to allocate capital globally.

- Foreigners own approximately 20% of US equities, 30% of Treasuries and 30% of US corporate credit8.

- The end of US exceptionalism is premature, particularly in equities.

- The dollar looks less exceptional with a weaker trade weighted dollar an expedient solution to closing trade imbalances. The net impact is reflexive, as the dollar declines total returns for foreign investors decline forcing portfolio decisions on hedges and dollar holdings.

- The US produces an enormous amount of financial assets to absorb rest-of-world savings and until recently, no other countries have been willing (or able) to serve this function.

- This might be changing in Europe, with concrete talk of finally creating a Eurobond market and large country fiscal packages including Germany and France.

- Government securities of reserve currencies are fungible with allocations driven by total return considerations.

- Large portfolios held by reserve managers, central banks, pension schemes and government-related entities are slow to change investment mixes but once they start moving, it leaves a long memory on asset prices.

- Be careful what you wish for. Smaller trade balances imply less recycling, which implies less demand for US assets.

- US equities are exceptional. Technology shares are an important contributor – via superior earnings growth – to the outperformance of US equities over the last few decades. Investors have limited choice when looking for mega cap hyper-scalers.

- China is already creating technology companies on par with its US counterparts, valuations remain low due to investor caution over the structure of Chinese financial markets. We could see this shift over time as China liberalizes its financial markets.

1 Source: Apollo Global Management

2 Deutsche Bank estimates a 40% decline in the nominal trade weighted USD would largely close existing trade imbalances.

3 As of July 4th, 2025

4 The ‘exorbitant privilege’ resulting from world reserve currency status.

6 In this piece, https://www.cfm.com/revisiting-the-mag-lag-7/ we argued that Generative AI is expensive to build versus software, implying earnings will be harder to scale going forward.

7 As of June 19th, 2025

8 Source: Apollo Global Management.

Disclaimer:

Any statements regarding market events, future events or other similar statements constitute only subjective views, are based upon expectations or beliefs, involve inherent risks and uncertainties and should therefore not be relied on. Future evidence and actual results could differ materially from those set forth, contemplated by or underlying these statements. In light of these risks and uncertainties, there can be no assurance that these statements are or will prove to be accurate or complete in any way. All opinions and estimates included in this document constitute judgments of CFM as at the date of this document and are subject to change without notice. CFM accepts no liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. CFM does not give any representation or warranty as to the reliability or accuracy of the information contained herein. The information provided is general information only and does not constitute investment or other advice. This content does not constitute an offer or solicitation to subscribe for any security or interest