Janan is a columnist for the Financial Times, writing about politics on Wednesday and culture on the weekend. He was US politics columnist between 2018 and 2022, based in Washington DC. Prior to the FT, he was the political correspondent for The Economist.

CFM Talks To: Janan Ganesh

CFM: If we can start big picture… A prevailing geopolitical discussion is the deterioration in US-Sino relations, with many, as such, now projecting a ‘decoupling’ between the world’s two largest economies. Do you think the extreme outcome, as per the strictest definition of the term, is likely?

JG: Because decoupling is such a radical concept, I have no expectation that it will ever happen.

The term was used a lot around 2018, when Trump turned up the dial on US-China rivalry. Since then, most politicians in Washington prefer to use alternatives such as ‘de-risking.’ Even China hawks are turning to alternative language.

When it comes to critical things such as semiconductor manufacturing, rare earths, sensitive IP, etc., I have no doubt the US is going to limit its exposure to China. But the notion that the West is going to ‘decouple,’ and effectively create two economic zones in the world, is not feasible. On trade, tourism, even international students, China is much more integrated into the world than the USSR ever was.

CFM: In this US-China stand-off, as well as on Russia and Ukraine, many countries have opted to stay ‘neutral.’ In a recent Foreign Affairs article, the author calls these countries – especially those in the global South, ‘fence sitters,’ arguing that these countries are hedging themselves against still uncertain geoeconomic outcomes. Do you think this is a fair summation of strategic non-Western foreign policy thinking?

JG: That is exactly how they are thinking about it, and it is clear to me that most countries will adopt a strategy of not choosing.

Remember, many countries have China as their principal trading partner, but the US as their principal security partner. I don’t believe, however, it would be a strategy as cynical as playing the superpowers off against each other, but rather one of preventing being boxed into a corner. Singapore and other Southeast Asian countries could become a model to follow.

The fairly obvious strategy for lots of countries for the next two or three decades will be one of ‘non-alignment,’ albeit a difficult one to execute.

CFM: To what extent do you think US foreign policy will accept this ambivalence?

JG: There is a limit to what US foreign policy can do. When the US was, by a substantial margin, the foremost superpower, it had far greater leverage. When there is a choice between superpowers, there is more scope for resisting US pressure. There is now, and will in the future be, an alternative.

Also, India is now the biggest country by population, in the top five economically, and destined to be even bigger in the future. It might become reasonable in time to start talking about a ‘tripolar’ world. If the EU were ever to get its act together in foreign policy, then you can add a fourth pole. And so on.

The US is going to have to work harder than it did in the past to court wavering countries. Global fence sitters will have more latitude.

CFM: Any geopolitical ‘de-risking’ draws into focus the play off between hard and soft power, and especially as it relates to resources. In a ‘race for resources,’ where China either directly or indirectly controls much of the supply of critical commodities, do you think China, or others, will lean more on hard power as a foreign policy strategy?

JG: Completely. And we have already seen a trailer for that in the behaviour of Russia, using its energy leverage over Europe, not just recently, but over the past 20 years. They tried and mostly succeeded to create a dependency relationship.

China might try to do something similar with rare earths and other commodities – where, as you pointed out, they have an advantage.

However, China is not so agriculturally or energy self-sufficient. The US is both of those things – or could be. It is also technologically self-sufficient to a large extent. So, the risk of any one superpower leveraging their advantage is that the other responds in kind. It’s another reason I don’t see ‘de-coupling’ being feasible. No one entity has absolutely everything.

For Russia it is gas and oil, for China is rare earths and related, for the US it is a combination of energy, agriculture, and technology.

CFM: If I take your meaning, you are saying: true, resource demand can and will be exploited as a foreign policy tool, but the impact might be overblown because of a still, and likely to endure neutralising force of co-dependence?

JG: Yes. No single state enjoys total dominance in all resources, and, therefore, the risk of trying to leverage whatever you’ve got, is that another player reacts with whatever they’ve got.

CFM: Presumably, this speaks to the calculus of policies towards greater self-sufficiency, and in turn, may further entrench progress towards a multi-polar world?

JG: There is clearly a trend in policy towards self-sufficiency. But I’m sceptical as to how successful it will ever be.

To be self-sufficient in most industries, you need a state industrial policy, which inherently goes against much of liberal economic thinking. So, first, a huge mental shift is needed. And even if this shift can be made, a state industrial strategy requires massive fiscal outlays, which typically means an increase in taxes, at a time when the tax burden, in the UK for example, is unusually high.

I talk to a lot of policy makers, who now, in the abstract, say: fantastic, politicians have finally woken up, we need our own manufacturing base, our own industrial strategy, let’s ‘re-shore’ jobs. But the voting public will have to bear a higher tax burden or give up other things. There is no switch to flip from open free markets to a much more strategic state. It’s a mental process, it’s a technical process, and above all it’s a fiscal process.

I think the ambition, as logical as it is in the abstract, is much more difficult than you would guess from the speeches and posturing about it.

CFM: Many organisations habitually curate a list of the top X risks facing the world. In this spirit, what risks do you think might have 1.) the biggest impact and 2.) are the most imminent in the near-term, say 2 years?

JG: The biggest impact event, undoubtedly, will be any sort of US-China military conflict. The scenario that is most often gamed out, at the Pentagon, by Rand and others, is that of a Chinese intervention in Taiwan. If the US responds with force, which Joe Biden implies it will, the risk is escalation into a major war. If the US doesn’t, the risk is that it loses credibility as great power worldwide.

Also on a practical level, if the conflict escalates, and takes the form of a blockade – there could be an interruption of global trade in one of the most important shipping regions on the globe.

But, that said, I don’t think it is the most likely scenario.

Most imminent is either Trump winning the next presidential election or some shift in the Ukrainian conflict – either a Ukrainian breakthrough or a settlement of some kind. The knock-on consequences of another Trump presidency would be profound. For one, a different approach to the Ukraine conflict.

CFM: Since you brough it up, I’ll put you on the spot. With a good handle on US politics, and through your many discussions with the D.C. set, what do you see as the probability of Trump being elected in 2024?

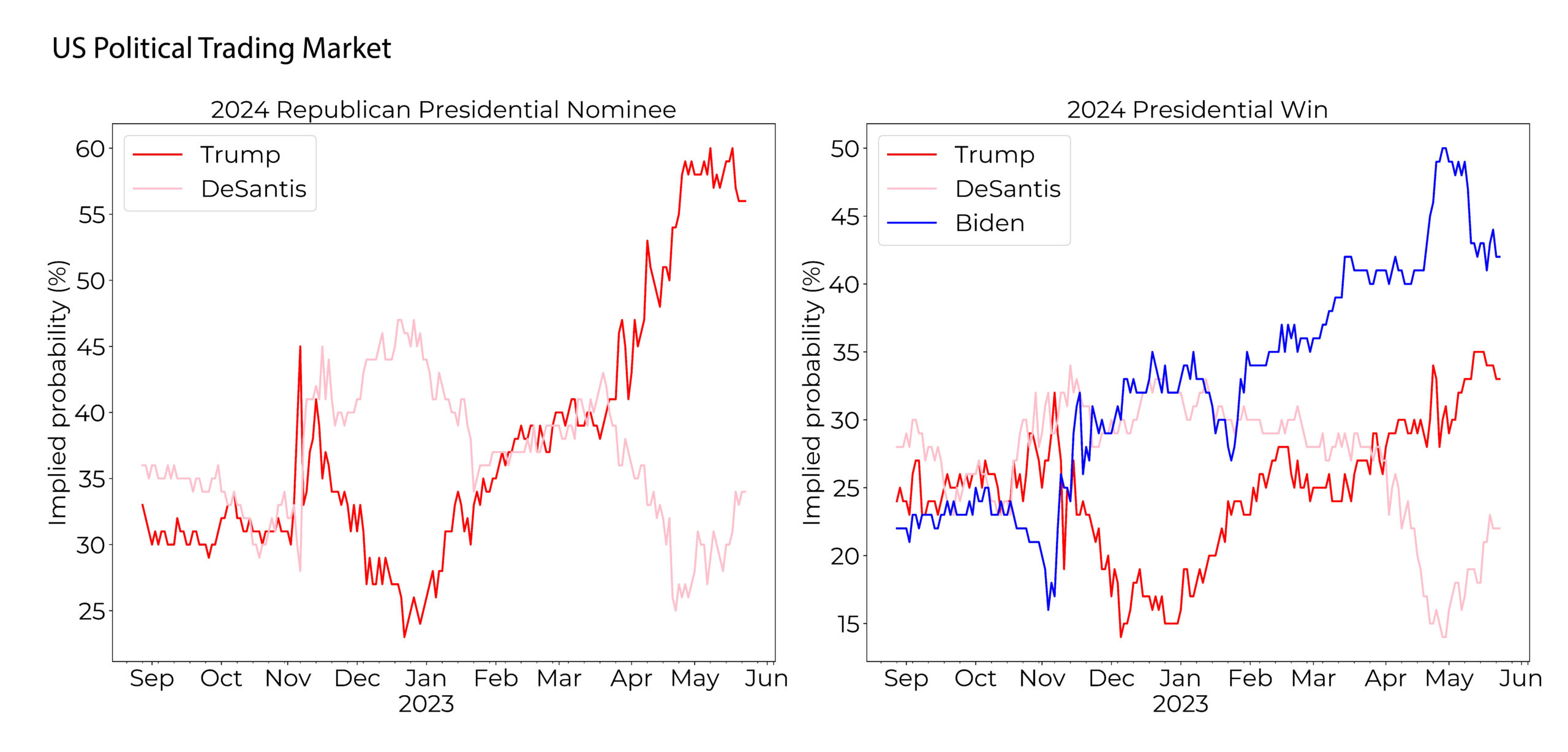

JG: More unlikely than likely. My instinct is if it is Biden vs. Trump, Biden wins. If it is generic Democrat vs. Trump, generic Democrat wins. If it is Kamala Harris vs. Trump, Trump wins. The dark horse is DeSantis. He is struggling in the primaries but, if he gets the nomination, he is likelier to beat a Democrat than Trump is.

CFM: Do you think Ron DeSantis is a viable contender?

JG: He is a completely viable competitor to Trump, simply because the Republican establishment and donor base has, to some extent, turned against Trump. Either because their affection to the man has changed out of principle, or they don’t believe he could beat any good Democratic candidate. There is a lot of money trying to find an alternative to Trump. And DeSantis – having governed a big state and having done it reasonably well – is an obvious choice. He offers a blend of 75% Trump – similar rhetoric and world view, while being technically much more able as well as being more predictable in his behaviour. DeSantis is a house-trained version of a populist.

However, I fear he lacks in the charisma and presence stakes compared to Trump. He is not a natural politician, and much more of a technocrat or an executive than a performer. While that is what you would like in a President, during the primaries your star power on stage is what is tested.

I therefore think, on balance, he might do better with the general public than he would during the Republican primaries.

CFM: Whilst staying moot on his views regarding Ukraine, DeSantis ultimately called it a “territorial dispute.” He said this because he either believes that it is, in fact, just that, or he was just pandering to the base. What are your thoughts?

JG: Probably pandering. To call it a territorial dispute was quite radical because it is not the official US position. It also deviates from what most Republicans in Congress think.

CFM: Nevertheless, if this is the attitude of a potential presidential candidate thinking it would animate the base, and, by extension, believing support might waver vis-à-vis Ukraine, do you think this could be a preview of a shift in US foreign policy?

JG: You’re right, this is a concern.

I do however think it is unlikely that there would be any major shift in policy. Under a Democrat, a shift is unlikely out of principle, under a Republican, for egotistical reasons. A Republican populist might have a secret sympathy for Russia, admire autocrats, and might think Ukraine has become a left liberal cause, but, they also hate the idea of the US taking a backward step on the world stage, conveying weakness and losing face. They like pointing out that only one president this century has not seen a Russian attack on another state happen on his watch, and that is Trump.

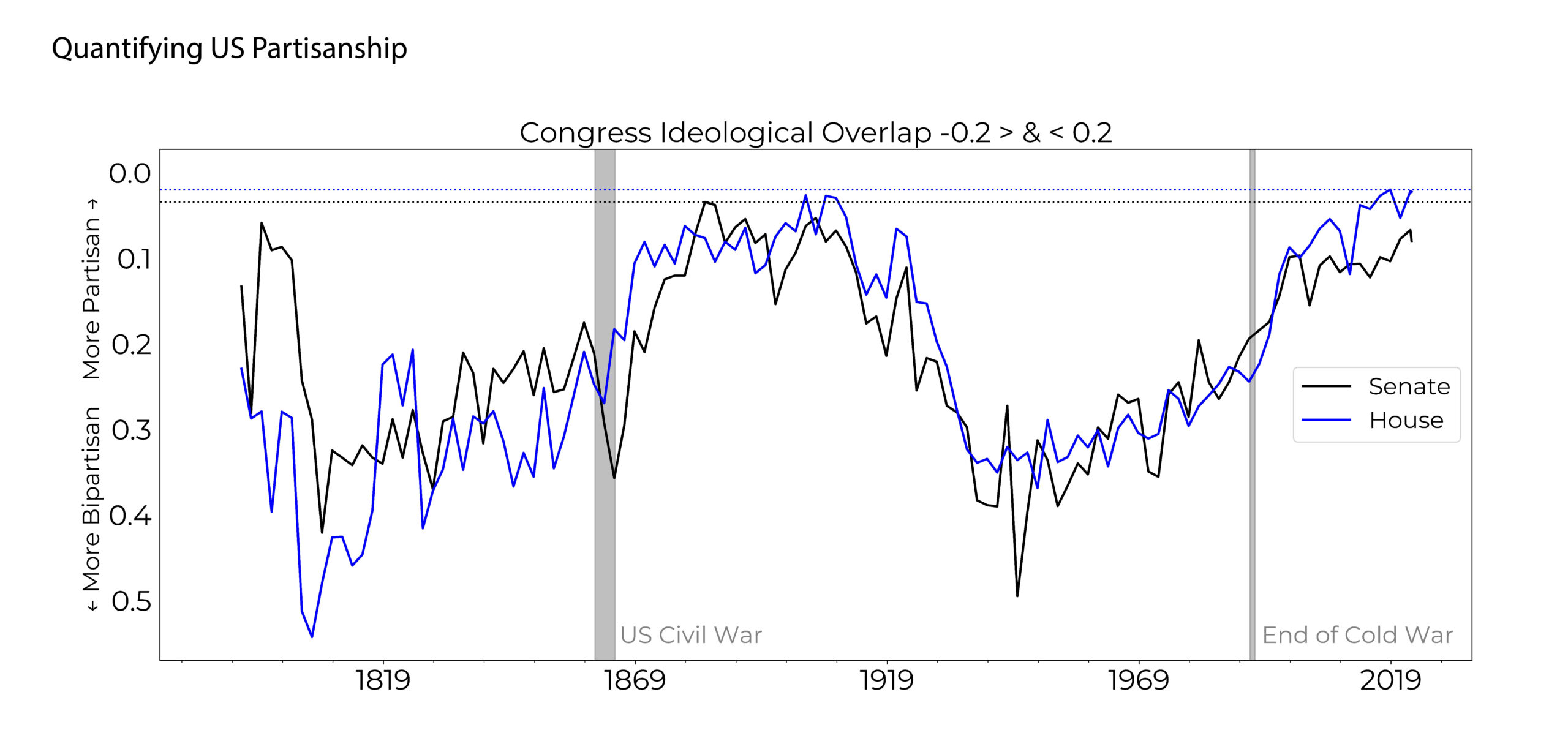

CFM: This offers a good segue into a topic we have written about before, and that is US partisanship. We took a novel approach of quantifying US political fragmentation and found, in agreement with anecdotal deduction, that the US is at-or-near record levels of partisanship. When and how do you think this trend towards high, dare I say extreme political partisanship started?

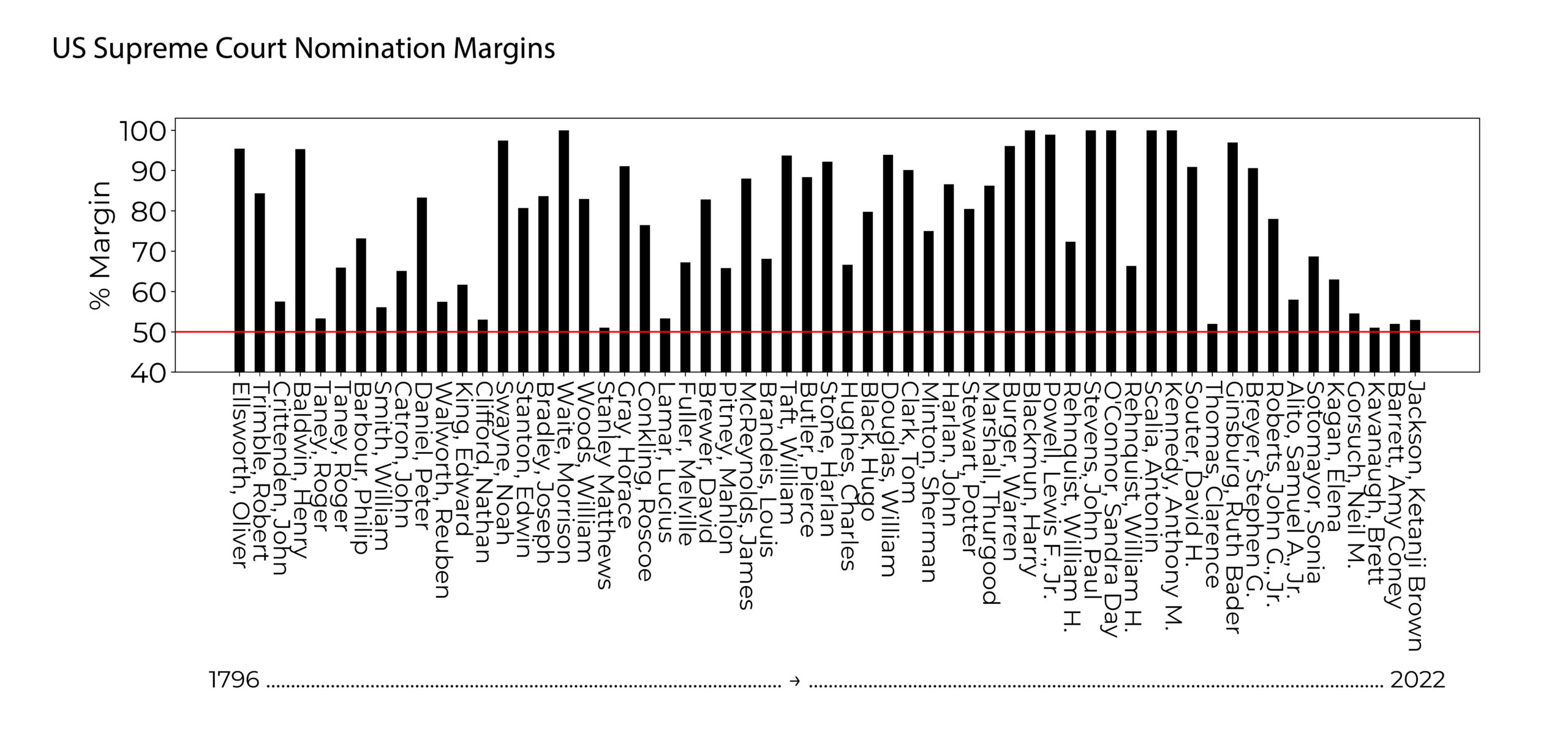

JG: I think modern US partisanship begins in the 1990s. If I had to isolate an event, it would be the 1994 midterms when a new kind of Republicanism led by Newt Gingrich – who became the Congressional leader, broke through. Before 1994, you obviously had a certain amount of competition and hostility between the two parties: we had McCarthyism in the 50s, and a lot of political division over Vietnam in the 60s, but these were always issue-based. There was also quite a bit of bipartisanship – US Supreme Court nominees, as a crude proxy, were being confirmed by overwhelming, very often unanimous margins for example.

Something, however, changed in the 1990s – the emergence of a much more aggressive and much more partisan style of politics, consciously so. Gingrich changed the tenor of Washington by being more ideologically on the front foot towards opponents of all stripes. An all-purpose partisanship.

The big question, is why? And why then? There are a lot of technical changes in American society that might explain it. For one, the Federal government deregulated cable news, and we ended up with Fox News and the liberal response to them. It makes political coverage more animated and aggressive. The internet enters most households at the same time, and that made political discourse much less edited and raucous. But these things are nebulous.

The big structural change is the end of the Cold War. The US loses its external rival. What happened, I think, is that the US turned in on itself. All that energy that was directed at a strategic competitor became directed to domestic political rivals.

CFM: If one follows your logic, and arguably we now have a rise of a true and substantial competitor in the form of China, do you think the level of partisanship may decrease in the coming years?

JG: If not the coming years, the coming decades. The way structural geopolitical change transmits into a domestic, social political change is naturally going to be very slow. There ought to be a softening of domestic political rhetoric, precisely because people’s minds are engaged with something external. If China continues to be a competitor – which it will be, especially economically and in time militarily, I just can’t see how the obsession with domestic political rivalry sustains itself. There is just not enough energy to go around.

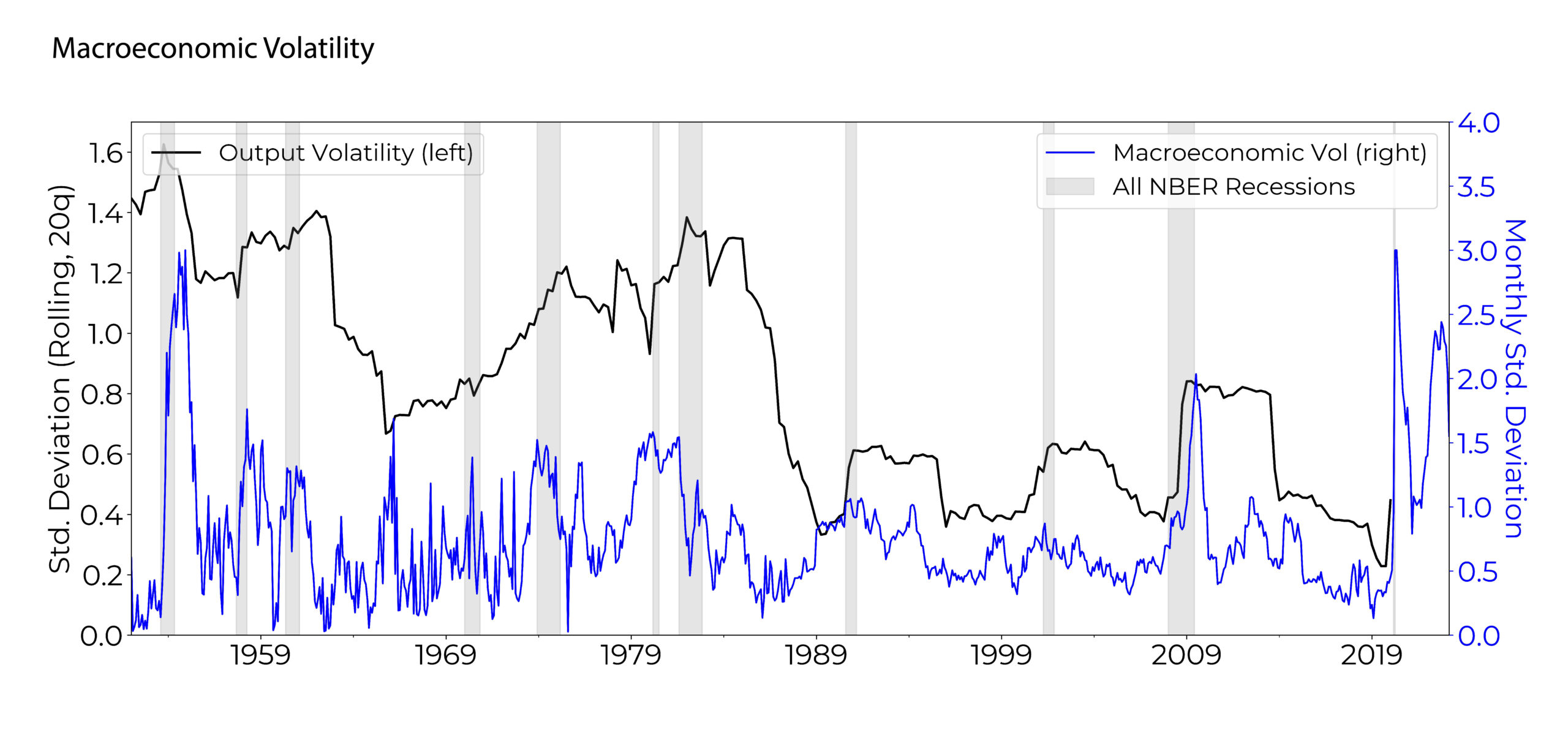

CFM: There is macroeconomic canon that the origins of the ‘Great Moderation’ from the mid-1980s onwards were in part because of a decline in geoeconomic rivalry, greater cooperation, more deregulation, and fewer exogenous shocks amongst others. If much of what we have discussed, greater rivalry, less cooperation, and even war come to the fore, would you expect a return to more economic volatility, lower growth, even more entrenched inflation?

JG: I can’t see how it can’t be true.

At the end of the Cold War, you had hundreds of millions of people entering the global labour force as their countries shifted from communist, to relatively open market economies. China plugged a billion people into the global economy. A huge entry of new workers, along with a new, relative consensus over free trade, naturally pushed down wages and had disinflationary effects on consumer goods. Every major geopolitical trend that I grew up with, and have been living with as an adult, has been in the direction of low inflation.

The kicker is that the world does not have another China. There is not another billion people to be imported into the global economy. Nor is there another end of the Cold War. There are physical, demographic limits that the world is now bumping up against.

Even if wasn’t for a change in policy, even it wasn’t for the turn in free trade, even if it wasn’t for the new industrial strategies proposed, just for demographic reasons there isn’t the potential to maintain the low inflation and moderation that we had since the 1990s.

CFM: You have talked about the fallacies of extrapolation, i.e., extrapolating from the current to predict what might happen in the future. From a geopolitical point of view, what do you think is the most erroneous extrapolation we can make today?

JG: The extrapolation I disagree most with is this very popular idea that Russia and China are now destined to be lasting, durable allies against liberal democracies. The reason this is believed is because all the contemporary evidence suggests just that. There is a good personal relationship between Putin and Xi Jinping; there is an ideological sympathy between autocratic states; and on Ukraine there has been a reluctance from the Communist Party to go against the Kremlin.

This is a troubling and daunting prospect for the West because of the scale of the two countries together. But people are making a huge extrapolation from very transient circumstances. If you take a longer view, they are likely to diverge in the future. For one, there is an enormous power gap. One is the second biggest economy in the world, conceivably the biggest in the next decade. The other has a total economic size similar to that of Spain, and sanctions will continue to bite. One has more than a billion people, the other has a 100 and something million. The gap is so big, that it can never be a partnership – I don’t see how they avoid a situation where China has the upper hand, and that causes friction.

The second is the historical record. How many autocracies cooperate with each other for extended periods of time? Bar a few fleeting examples, nationalists have a dismal record of international cooperation. The Soviets and China couldn’t hang together for long during the Cold War.

Janan spoke with André Breedt, VP in the research team based in Paris.

[1] Partisanship in the US Congress since 1789. Has the US reached peak political fragmentation? The paper is available for download on our website here.

[2] Olivier Blanchard & John Simon, 2001. “The Long and Large Decline in U.S. Output Volatility,” Brookings Papers on Economic Activity, Economic Studies Program, The Brookings Institution, vol. 32(1), pages 135-174.

[3] We take the YoY percentage changes of key macroeconomic variables of G6 nations and normalise each by dividing by its own standard deviation. We then clip the time series of each macroeconomic variable at 3 standard deviations in order to treat for the outliers. We then calculate the average standard deviation across each of the normalised and clipped variables for each month.

DISCLAIMER

The text is an edited transcript of an interview with Janan Ganesh in May 2023 in New York and have been edited for length and clarity. The views and opinions expressed in this interview are those of Janan Ganesh and may not necessarily reflect the official policy or position of either CFM or any of its affiliates. The information provided herein is general information only and does not constitute investment or other advice. Any statements regarding market events, future events or other similar statements constitute only subjective views, are based upon expectations or beliefs, involve inherent risks and uncertainties, and should therefore not be relied on. Future evidence and actual results could differ materially from those set forth, contemplated by or underlying these statements. In light of these risks and uncertainties, there can be no assurance that these statements are or will prove to be accurate or complete in any way.