We had the pleasure of talking with Mr Jack Inglis, CEO of the Alternative Investment Management Association (AIMA), at the end of an eventful year for global capital markets. While now advocating for the alternative investment industry, Jack has had a long career in the finance industry that included stints at Morgan Stanley, Barclays and London-based hedge fund Forex Capital Management where he was CEO. He also currently serves on the board of the Chartered Alternative Investment Analyst Association (CAIA) and is Chairman of Help for Children UK. Jack is not only uniquely qualified for his current role at AIMA, but commands a vantage point which allows for unique insight into the state of the industry currently, as well as its future. We discussed the work of AIMA, its ambitions, as well as many of the challenges and opportunities for the hedge fund industry.

Jack Inglis fade with quote

CFM: What is AIMA’s elevator pitch?

JI: As a membership organisation, our members have access to more benefits mutually, than they would have had individually. Generally speaking, these mutual benefits (or services) are categorised along three main axes.

First, advocacy: the industry is far better served by a united front (for instance on policy and regulation matters) to achieve appropriate and proportionate outcomes than what firms individually would have been likely to muster.

Secondly, we are able to bring collective intelligence from the industry, and deliver it individually to firms. Think of this as ‘education’.

And lastly, we facilitate communication. Not only between members, but also externally to a broader audience, particularly investors. Likewise, channels of communication with and between other relevant stakeholders such as regulators, policy makers, and indeed, the general public are also facilitated.

CFM: Indeed, to engage more with the general public, AIMA partnered with ITN in the UK to produce a short film about alternative investments. How did this partnership come about?

JI: The alternative investment industry is largely misunderstood. So the real purpose of this partnership is to create awareness – an awareness of the benefits of the alternative investment industry for millions of savers around the world.

This especially given that the mainstay of most investors’ portfolios today, government bonds and equities, are respectively offering near to or even below zero yields, and continued performance are questioned – given its exceptional 10-year run.

This initiative is therefore primarily intended to build an awareness as to how alternative investment funds act as diversifiers to traditional asset classes.

But, likewise, creating an awareness of the real positives coming from the activities of the alternative investment industry, such as the flow of capital – especially private capital to the right opportunities, which, given the current economic climate, is more important than ever.

CFM: How do you think the view of hedge funds has changed amongst investors versus, say five year ago?

JI: Institutional investors – from where the bulk of capital is allocated today – have a very deep understanding of hedge funds. There are, to be sure, varying degrees of appetite for hedge funds, largely because returns have been mixed, especially when compared – on an absolute return basis – to long-only-investments in equity markets of late.

However, what I found very interesting in 2020, were the results of various surveys of allocators and their portfolio allocation positioning and preference: hedge funds found themselves near or at the top, which is a reflection of the uncertain market environment we find ourselves in (and in which we are likely to remain), and also the good performance of hedge funds in a particularly challenging year.

CFM: Same question, but as it relates to quantitative and or systematic strategies – how do you think has the view changed?

JI: I think there is a marked difference in opinion. There used to be a certain reluctance of investing in what was ill-or-misunderstood. This attitude no longer exist. In part because investors can no longer ignore some of the successes of ‘quant’ funds.

I also believe many of these funds, like yourselves, have done very well in educating investors about the process and philosophy of quantitative and systematic investing. Investors are as a result much more accepting of these funds being part of their investment mix.

And, let’s not forget, quantitative managers have made great strides in being first adopters in many of the new technologies being employed. Investors had to learn for instance what Big Data is, what Alternative Data is, what AI is – and as a result, there is far greater acceptance and understanding of how technology can improve everything around us. Much of this thanks to the pioneering work quants have done.

In short – there is a willingness to understand, believe, and finally accept how quantitative investing can and should play a central part of portfolios, along with a confidence in those that embrace such technologies in their investment process.

And, of course, I think the growth of assets under management of firms identified as quant or systematic is self-evident of a broader acceptance by allocators.

CFM: A discussion quite prescient of late is the multi-manager vs. single manager debate. Do you perceive any particular preference for one of these two approaches?

JI: I don’t think it is an either/or situation. As an allocator, what are you seeking? Typically diversification, risk reduction, drawdown protection, superior uncorrelated returns, or any combination of those things that align with your investment objectives.

Few allocators will be solely focussed on the manager structure as much as they would be on quality managers that deliver alpha in a risk-controlled way. Multi-managers can immediately offer diversification, while single managers can add a distinct specialisation offering. Both will continue to play their own unique role in the industry.

CFM: Journalists often like to take a stab at hedge funds’ returns compared to an arbitrarily chosen market cap weighted equity index. Despite many efforts to highlight the value proposition of hedge funds (including a paper AIMA wrote in 20141), the industry is subject to continued negative press. Is there something more philosophically profound about this constant critique?

JI: It does aggravate me to read stories castigating hedge funds’ performance. Many of these stories also typically sing from the same playbook, since it is very easy to make the comparison with say the S&P 500.

I call this lazy journalism.

Part of the problem goes back to the original concept of hedge funds who were seen to serve ultra-high net worth individuals or a few select clients who were beneficiaries of super-charged returns. As the industry became more institutionalised, and the make-up of the client base shifted, it changed very significantly along with investors’ thinking and requirements about risk-adjusted returns. Somehow I feel the media has not caught up with how hedge funds have evolved. Hedge funds are still routinely branded as super risky, which is clearly not accurate.

We at AIMA are charged with highlighting that hedge funds – compared to a long only equity portfolio – is not more risky, and have a completely different value proposition.

Nevertheless, what I often hear asked this year, especially to allocators, is do you think hedge funds are justifying their fees. Their common response is yes, they are demonstrating value. Recent reports have also highlighted that hedge fund allocations have either met or exceeded investor expectations. Additionally, most sensible allocators know better to chase performance, but rather use hedge funds as a means to customise their portfolios.

However, it does seem true that alpha has declined in recent years. Nevertheless, it appears that there are again some real tangible alpha opportunities in the market that hedge funds are able to capture. When hedge funds – especially in March of this year – show they can protect investors’ assets, one is reminded that this is what allocators are willing to pay for.

“Additionally, most sensible allocators know better to chase performance, but rather use hedge funds as a means to customise their portfolios.”

CFM: I would like to touch upon what you said regarding alpha and alpha decay. How would you respond to claims that this is correlated to the size of the industry?

JI: Clearly the hedge fund industry has grown. However, what is frequently skimmed over, is that the size of capital markets – public equity market, debt markets, derivative markets etc. – have grown substantially. In terms of hedge funds’ position relative to the overall market, it is not yet attained a size that could lead to a conclusion that hedge funds are dominant in the market, nor indeed that opportunities have dried up.

I think the alpha ‘erosion’ or ‘decay’ over the past, say decade, is the result (albeit at different speeds) of all ships rising. As a result, intra-stock correlation has been at much higher levels than has been observed historically. And when that correlation is so high, it mechanically reduces opportunities – especially for funds who are selecting securities on both the long and short side. In a word, it limits both the opportunity set and reduces the profitability within the opportunity set.

However, amidst Covid-19, and many other momentous changes a foot, there is a high likelihood of decreasing correlations, and as a result, increased alpha opportunities since lower correlation between markets and securities present more opportunity for the style and flexibility that hedge funds are able to put to work in the market.

CFM: Jumping Heightened volatility is another element cited as being constructive for hedge funds. Do you have any expectations?

JI: Indeed. Higher levels of volatility has traditionally presented opportunities for hedge funds. Moreover, most of the expectations are – certainly following a survey we did recently – that elevated levels of volatility are going to remain in the near and medium term.

This, combined with the argument of decreased correlation we discussed earlier, makes for a theoretically beneficial backdrop for hedge funds. We think this should provide a boost in the appetite for the industry.

CFM: Given perhaps this boost in appetite for hedge funds, what do you think the opportunities are for new launches?

JI: The barriers to entry have gone up. Absolutely. There are higher cost, more regulation, and much more besides. But, all these are not acting as such a big deterrent as one might think. Many still want, and do set up their own firms. Even in 2020 – probably one of the toughest years to have set up a new business – quite a few examples of new funds launched with over a $1 billion.

But, when we discuss this, we stress that new launches do not need, say a $1 billion. We have run multiple surveys to ascertain what level of AUM is needed to launch a viable fund. And the results, and what we observe from talking to members, do not square with commonly held views.

There is a very long tail of successful managers that manage less than $250 million and surveys confirm that the ‘breakeven’ for new funds – with all the usual caveats applied – is roughly $100 million. And part of the reason that smaller funds are viable, is that much of the costs can be outsourced these days.

Nevertheless, if you are wanting to attract institutional money, it would be difficult to attract attention if you are below the $250 million level.

CFM: Larger managers have broadly enjoyed a much larger chunk of AUM flows, especially in recent years. Has the importance of e.g. size, brand recognition, pedigree, reputation etc. become even more indispensable for asset raising and retention?

JI: Undoubtedly, these qualities are incredibly important. And you are right, the big have become bigger. However, a manager cannot rely on its brand or reputation to exist in perpetuity – these are fickle things. Performance is and will remain paramount.

But remember, there are rather simple reasons why bigger managers attract bigger tickets: if you are an allocator, you can put much more money to work very quickly with bigger managers because you will likely not be an outsized portion of their total AUM. Moreover, job security among allocators is surer with an allocation that fails to deliver at a large, reputable manager than a smaller niche name.

There is of course another consideration, with much research on the topic, namely, who performs better: the larger well-known managers, or the smaller, more ‘obscure’ funds? Some studies suggest smaller funds perform better… Irrespective, I have seen over the past couple of years a much greater willingness amongst allocators to consider emerging managers for opportunities that they might have overlooked in past.

CFM: We were very glad to have contributed to a recent AIMA paper on sustainability and short selling4), arguing that the practice is fully compliant with sustainable investment. Why do you think there was (perhaps remain) a certain aversion of short selling vis-à-vis sustainable investment or ESG?

JI: Short selling is, in certain quarters, controversial regardless of whether it is deployed for ESG purposes or not. We saw this for instance earlier this year when short selling bans were enacted in France, Italy and elsewhere.

With our paper, what we argue I think very successfully, is that it is not socially irresponsible – in fact, it has many advantages such as being able to adjust behavior in corporate management if a company is shorted for ESG reasons. The practice can accelerate governance and management change in companies so as to get back on track to meet certain ESG standards or goals, amongst others – all of which is, and will become much more important to investors.

CFM: AIMA is quite active in expanding its presence and reach in Asia Pacific. How has interest from managers evolved regards to especially China?

JI: I would say there are two part to this. One, the opportunity in markets in the whole of the Asia Pacific region, and two, homegrown talent establishing themselves as managers in the region. The markets there have always attracted firms that want to trade them. The Japanese stock market is the largest outside of the US and a manager who wants to trade global markets have to trade Japanese equities.

But, as you alluded, the biggest opportunity is undoubtedly China. We all know the story – the economic growth, stock market growth, and, critically, how it is opening up and providing access to non-Chinese investors. It is too big to ignore, but foreigners have had a hard time of it trying to make money there in the past.

But all the signs show that they are opening up further, whether you are a foreign fund manager wanting to establish yourself on mainland China – and raise money in mainland China, or trade markets as more instruments become available and more quota is made available by the Chinese. Signs are that the direction is positive in all respects, so, inevitably it will be an area of growing interest.

CFM: Jumping back to London, where you are based. What is the sentiment of your UK-based members post-Brexit?

JI: London has established itself over many decades as a premier financial center. As a result, you have a massive cluster effect that makes it a very attractive place to do business. This cluster effect has also attracted global talent – including many in ancillary and supporting services.

It would take quite a lot to disperse that.

In the international world of finance, English is and will in all likelihood also remain the dominant language – a very beneficial bit of luck for London and those who do business there.

In short, there needs to be very compelling reasons for businesses – especially in the finance industry – to move, wholesale, their base out of London. At the moment, through most of our discussions, members appear to be apprehensive (and have contingency plans and necessary regulatory plans in place), but remain committed to London. There is a huge desire to stay in London and benefit from many of the advantages that the clustering effect provides.

CFM: In talking to your members, is there anything particular they are preoccupied or concerned with?

JI: There are really only two important things in the life of a fund manager, and that is delivering performance and keeping your clients happy. If you do those things right you are likely to have a very successful business.

Beyond that, what has become very obvious, is the escalation in operational complexity required to run a hedge fund. The risks – reputational, financial penalties, etc. – of getting it wrong, especially from a legal and compliance perspective, have grown exponentially. Naturally, there are also – at least in Europe – the regulatory burdens related to Brexit. Beyond that, we are keeping a close eye on increased prudential regulation – for instance the limit on leverage limits, as a potential concern.

But, I think front of mind, naturally in this moment in time, is how the future of the office will look like. What should managers be doing to mitigate any of the intangible losses owing from the large work-from-home experiment. We don’t have the answers yet, and everyone wants to know how everyone else is thinking about it. This is another example where AIMA can be helpful, in mediating these kind of conversations.

“There are really only two important things in the life of a fund manager, and that is delivering performance and keeping your clients happy.”

CFM: And what do they see as the opportunities?

JI: There is loud agreement that sticking ones money in sovereign bond markets doesn’t seem to be a particularly sound investment strategy if you are seeking returns for savers. Moreover, I think the precariousness of being so over-weighted equity markets has never been more obvious.

Combined, institutional investors seem to be cognisant of the role hedge funds can and, may I say, should play in their portfolios.

Moreover, many of the best hedge funds are already in a position to benefit from the pace of technological change and the huge advances in scientific techniques applicable in investment management. Many are exploiting the sheer amount of new data being produced daily – much of it unstructured – to uncover interesting and actionable investment signals.

Our industry is at the vanguard of all this technological discovery and usage, particularly in the investment process, and are as such well-poised to succeed in the future. Those firms, like yourself, who have adopted such an approach very early on, are in extremely good position to benefit from the coming changes in the investment industry.

Jack spoke with André Breedt, Research Associate in our Paris office.

For more information on AIMA and a selection of their work please see their website.

[1] ‘Apples and Apples: How to better understand hedge fund performance’, AIMA Journal Q2, 2014.

[2] For a more detailed look at the performance of equities in the years 2010-2020 in a historical context, we refer you to our whitepaper ‘Lucking up, until beta fails’ available on our website: https://www.cfm.fr/insights/lucking-up-until-beta-fails/

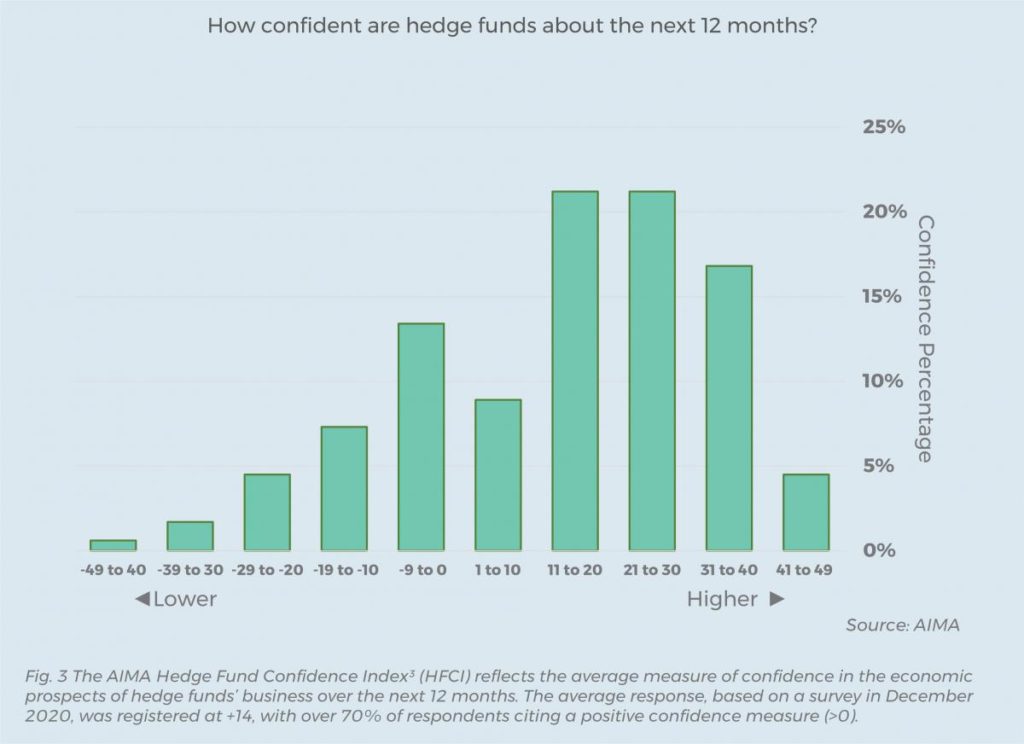

[3] AIMA, along law firms Simmons & Simmons and Seward & Kissel launched the index in Q4 2020. The HFCI will be published at the end of each quarter and considers hedge funds managers’ level of economic confidence based on ability to raise capital; generating revenue and manage costs; along with taking into account the overall performance of their fund(s). Data with the thanks to AIMA.

[4] Short Selling and Responsible Investment, AIMA 2020. Download the report here: https://www.aima.org/sound-practices/industry-guides/short-selling-and-responsible-investment.html

DISCLAIMER

THE TEXT IS AN EDITED TRANSCRIPT OF A PHONE INTERVIEW WITH JACK INGLIS IN Q4 2020. THE VIEWS AND OPINIONS EXPRESSED IN THIS INTERVIEW ARE THOSE OF JACK INGLIS AND MAY NOT NECESSARILY REFLECT THE OFFICIAL POLICY OR POSITION OF EITHER CFM OR ANY OF ITS AFFILIATES. THE INFORMATION PROVIDED HEREIN IS GENERAL INFORMATION ONLY AND DOES NOT CONSTITUTE INVESTMENT OR OTHER ADVICE. ANY STATEMENTS REGARDING MARKET EVENTS, FUTURE EVENTS OR OTHER SIMILAR STATEMENTS